The majority of Americans are one emergency expense away from being unable to sustain their current lifestyle or from going in to greater debt.

Vehicles break down and require unexpected expensive repairs. People get sick and need medical care that often comes at a significant financial cost. Dozens of other life challenges occur that necessitate spending well beyond the normal monthly budget occur from time to time.

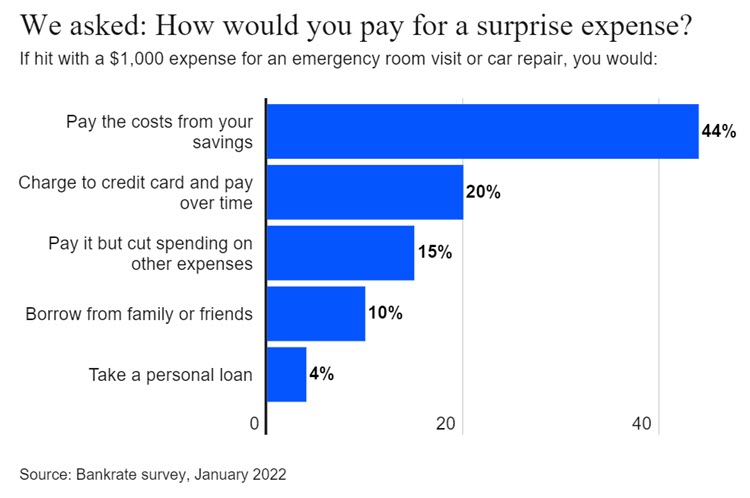

And, according to an annual survey conducted by Bankrate, only 44% of Americans would fund an unexpected emergency expense of $1,000 using their savings.

- Less than 1/2 of the US population has indicated an ability to cover this level of a surprise expense in any of the years the survey has been conducted (the prior eight surveys found that between 37% and 41% of Americans would do so).

- Less than 1/2 of respondents in any age cohort (Generation Z, Millennial, Generation X, Baby Boomer, or Silent Generation) answered that they would cover the surprise expense using savings.

- In this year’s survey, more than 1/3 of Americans indicated they would choose to increase debt in order to cover a surprise expense (20% through credit card debt, 10% by borrowing from family or friends, and 4% by taking a personal loan).

(screenshot from bankrate.com/banking/savings/financial-security-january-2022/

So What?

A great deal of recent research supports the importance of emergency savings. This simple annual survey provides a practical reminder of how such a financial cushion is helpful.

The question is not if, but when any one individual or family will face a surprise expense. Surprise expenses happen in everyone’s life, and, when the bill comes to $1,000 or more, generate difficult decisions for more than half of Americans.

Helping people aspire to start an emergency savings account, and providing them with support in their journey to fully fund it (at whatever level they establish as their goal) is life changing work.

- If you encountered a surprise expense of $1,000 today, how would you pay for it?

- What does your faith community do (1) to support people who have these expenses and cannot afford them, (2) to partner with other churches and/or nonprofit agencies that provide emergency financial assistance, (3) to provide tools and support to those seeking to build an emergency savings or reach other financial goals, and (4) to partner with other churches and/or nonprofit agencies that provide these services?

This topic is personal for me. Over the last five years I’ve been involved in faith-based nonprofits that seek to do this work in collaboration with local faith communities, other non-profits, and like minded for profit partners.

At the White Rock Center of Hope we recognize this is one element of a larger goal: helping people achieve and maintain economic self-sufficiency. And, we are committed to continuing to learn how best to come alongside people on their journeys. Additionally, we know that this work is complex and multi-layered on the individual level, and is impacted by multiple systems. We also recognize the importance of addressing the immediate financial crisis while also working toward longer term goals alongside the work of advocating for more just and equitable systems.

I’d welcome learning more about the work you, your congregation, your nonprofit, or other groups you are a part of are seeking to address the troubling reality that less than half of Americans have savings to cover their next surprise expense.