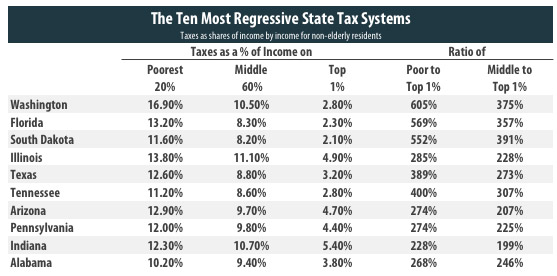

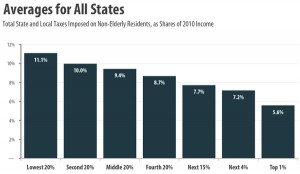

Earlier this year the Institute on Taxation and Economic Policy released the 4th edition of “Who Pays: A Distributional Analysis of the Tax Systems in All Fifty States.” This report finds that “virtually every state’s tax system is fundamentally unfair, taking a much greater share of income from middle- and low-income families than from wealthy families” (Executive Summary, p.1). The image at right illustrates the regressive reality of the national averages for the percentage of income paid on state and local taxes based on wages earned by percentile. The image below highlights the nation’s most regressive states in this regard.

Earlier this year the Institute on Taxation and Economic Policy released the 4th edition of “Who Pays: A Distributional Analysis of the Tax Systems in All Fifty States.” This report finds that “virtually every state’s tax system is fundamentally unfair, taking a much greater share of income from middle- and low-income families than from wealthy families” (Executive Summary, p.1). The image at right illustrates the regressive reality of the national averages for the percentage of income paid on state and local taxes based on wages earned by percentile. The image below highlights the nation’s most regressive states in this regard.

So What?

I have spent my life in two of the worst offenders insofar as being extraordinarily regressive in taxation: Florida (#2) and Texas (#5). For me, the most troubling aspect of this report is contained in the following quote:

Combining all of the state and local income, property, sales and excise taxes state residents pay, the

average overall effective tax rates by income group nationwide are 11.1 percent for the bottom 20

percent, 9.4 percent for the middle 20 percent and 5.6 percent for the top 1 percent (Executive Summary, p.1).

Regardless of one’s political preferences, it is essential to struggle with taxation from the perspective of one’s religious understanding.

- As a person of faith, does the overall pattern of regressive taxation in the US trouble you? Why or why not?

- Do you believe the existing system in general and in the most regressive states more specifically is in need of reform? If so, how would you envision such a shift?