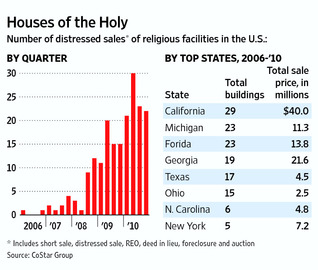

Local churches often finance the purchase of a new “house of worship” (or expansion of an existing one) with a mortgage much like their parishioners do when purchasing their own homes. Historically churches have had low default rates, but more recently high unemployment and easy access to funding have contributed to increases in distressed (see image at right) properties. Foreclosures have also risen dramatically. According to a recent Wall Street Journal article written by Sherry Banjo:

Local churches often finance the purchase of a new “house of worship” (or expansion of an existing one) with a mortgage much like their parishioners do when purchasing their own homes. Historically churches have had low default rates, but more recently high unemployment and easy access to funding have contributed to increases in distressed (see image at right) properties. Foreclosures have also risen dramatically. According to a recent Wall Street Journal article written by Sherry Banjo:

Since 2008, nearly 200 religious facilities have been foreclosed on by banks, up from eight during the previous two years and virtually none in the decade before that, according to real-estate services firm CoStar Group, Inc.

So What?

As one might expect, the states with the most distressed religious properties (California, Michigan and Florida) are also states with very high rates of distressed and foreclosed real estate. Rather unexpectedly some congregations are choosing to simply stop paying their mortgages and to walk away.

- Based on your understanding of Christian principles, is it ever permissible for a congregation to simply stop paying and walk away from a property it owns? Why or why not?

- Does your congregation have any debt related to new construction or campus expansion or renovation projects? Are they a significant financial burden as a percentage of your church’s operating budget? How might the current increases in distressed religious properties impact any planned reworking of these notes?